Achieve Financial Stability: The Importance of Portfolio Diversification

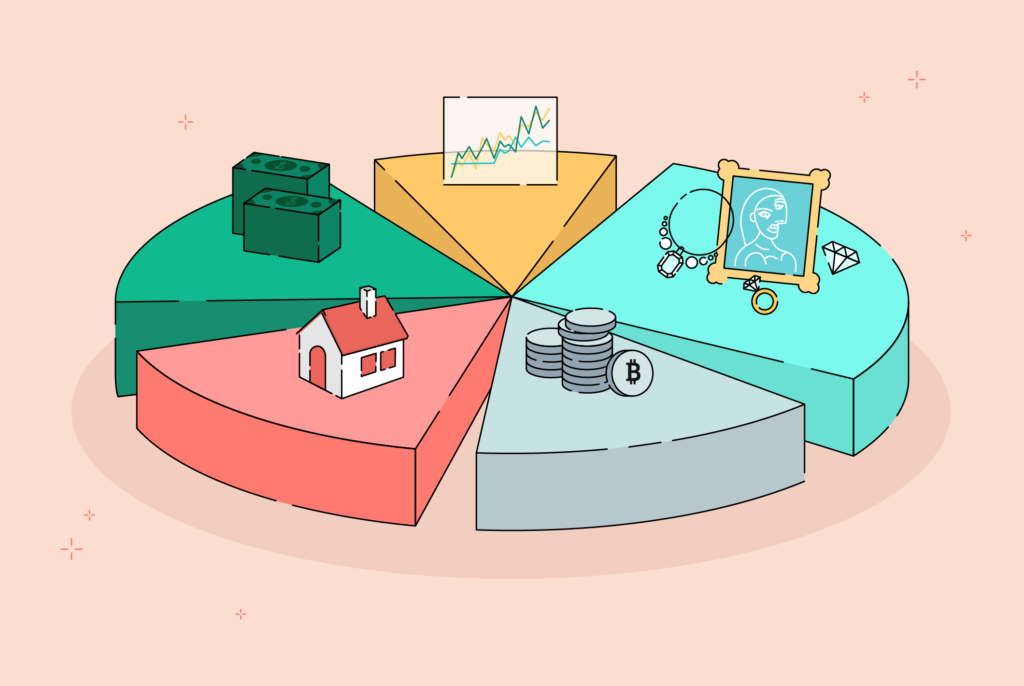

Diversification is a strategy that involves spreading your investments across various asset types to limit exposure to any single asset. This approach aims to reduce the overall volatility of your portfolio over time.

Balancing Risk and Reward

To invest successfully, you must balance your risk tolerance with your investment time horizon. Investing too conservatively when young risks insufficient growth to outpace inflation and meet retirement needs. Conversely, investing too aggressively when older exposes your savings to market volatility, which can be detrimental when you have less time to recover from losses.

Key Components of a Diversified Portfolio

- Domestic Stocks:

- Represent the most aggressive portion of your portfolio.

- Offer higher growth potential but come with higher short-term risk.

- Bonds:

- Provide regular interest income and are less volatile than stocks.

- Serve as a cushion against market fluctuations.

- High-quality bonds offer lower long-term returns but greater stability.

- Short-term Investments:

- Include money market funds and short-term certificates of deposit (CDs).

- Offer stability and easy access to funds but typically yield lower returns.

- International Stocks:

- Provide exposure to non-US companies, offering different growth opportunities and risks.

Additional Diversification Strategies

- Sector Funds: Focus on specific economic segments and can be useful in different economic cycles.

- Commodity-focused Funds: Hedge against inflation by investing in commodity-intensive industries.

- Real Estate Funds: Include real estate investment trusts (REITs) to diversify and protect against inflation.

- Asset Allocation Funds: Managed to specific goals or target dates, these funds simplify diversification for investors lacking time or expertise.

Benefits of Diversification

The main goal of diversification is to limit the impact of volatility on your portfolio, not to maximize returns. For example, a portfolio with a mix of US stocks, international stocks, and bonds can offer solid long-term returns with reduced extreme highs and lows compared to a portfolio heavily weighted in stocks.

Incorporating Time Horizon and Risk Tolerance

When building your portfolio, consider your time horizon and risk tolerance. For long-term goals, like retirement, you might accept more risk for higher growth. However, your comfort with risk is crucial; even with a long horizon, a balanced portfolio might be more suitable if you’re risk-averse.

As your time horizon shortens, reallocate to more conservative investments to reduce exposure to volatility. In retirement, a significant portion of your portfolio should be in stable, income-generating investments, yet still maintain some growth-oriented assets to combat inflation and ensure your savings last.

Conclusion

A diversified portfolio is essential for managing risk and achieving your financial goals, regardless of your time horizon or risk tolerance. This foundation helps ensure a balanced approach to growth and stability.